Last week's webinar A Global Paradox: Navigating Progress and Protests can be viewed HERE Troy Media published the associated article as Global Stability on the Brink HERE

|

|

ELECTION FORECAST MANNERS MATTER Women Speak Out POLITE & CIVIL TRUMPS RUDE & CHAOTIC |

Wealth Inequality: Disparity Driving Discontent

During November KEI is exploring the drivers of the Paradox of Prosperity and Protesting. The following article is a simulated interview about by KEI of Perry Kinkaide. Perry draws on content of an article HERE and contributions received from the KEI Network on the topic of rising wealth inequality contributing to the global paradox.

Perry Kinkaide, Editor and Host of the KEI Networks newsletter and associated webinar discussions - accessible HERE. The Network is comprised of 16,000 contacts with an interest in the clash of public and personal interests including the impact of emerging technologies. Do consider making a pledge at KEInetwork.net to help us defray costs for maintaining the Network.

Perry Kinkaide, Editor and Host of the KEI Networks newsletter and associated webinar discussions - accessible HERE. The Network is comprised of 16,000 contacts with an interest in the clash of public and personal interests including the impact of emerging technologies. Do consider making a pledge at KEInetwork.net to help us defray costs for maintaining the Network.

KEI: Thank you, Perry, for joining us to discuss the pressing issue of wealth inequality and its impact on society. Let’s start with a broad question. What’s your perspective on the current state of wealth inequity worldwide?

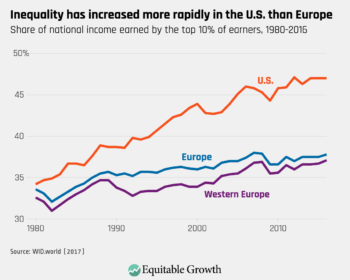

Perry Kinkaide: Thank you for having me. Wealth inequality particularly in the United States compared with Europe, has certainly grown to unprecedented levels, and especially in the past few decades.

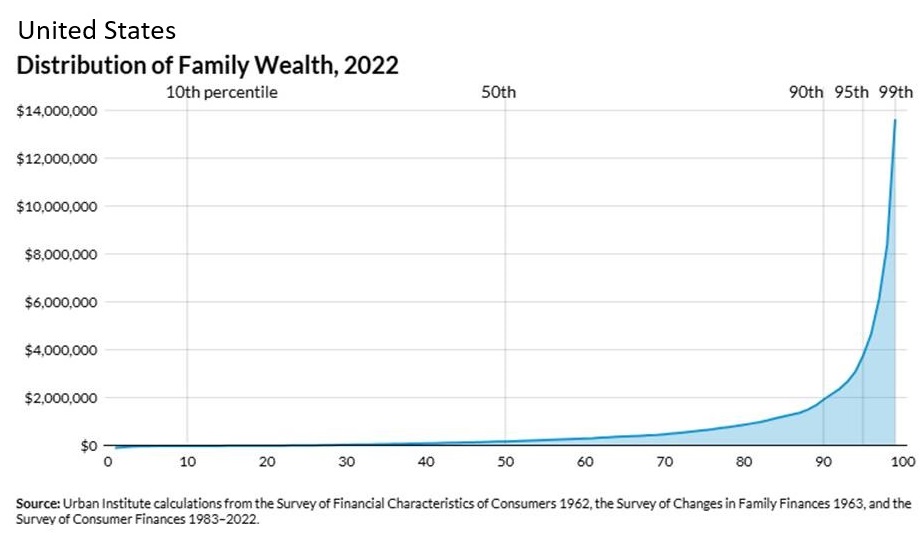

We’re seeing a concentration of wealth in the hands of a few - wealthy, white, homeowners, with significant liquid retirement savings, which not only stifles economic opportunities for the majority but also leads to deeper societal challenges and protests.

I found particularly insightful the Urban Institute's Report https://apps.urban.org/features/wealth-inequality-charts/ HERE featuring charts illustrating the wealth disparity between income groups, ethnicity, race and gender. The huge and widening gap isn’t sustainable long-term; it fosters frustration, limits upward mobility, and fuels a sense of injustice, especially when economic growth doesn’t benefit everyone.

KEI: Many experts argue that wealth inequality has surged dramatically. What do you believe are the primary drivers behind this trend?

Perry Kinkaide: The reasons are multifaceted. Wage stagnation, technological advances that favor high-skill or capital-intensive industries, and policies that often benefit capital owners are central factors. Globalization has also contributed by shifting jobs to lower-cost labor markets, especially in manufacturing. On top of that, tax systems in many countries increasingly favor the wealthy, allowing capital gains and inheritance wealth to grow untaxed or minimally taxed. Trickle down economic programs are employed to encourage the wealthy to invest and reward their role in job creation, philanthropy, and increased consumer spending. However, extensive research and international experience conclude that not only doesn't it work, but it also further entrenches wealth inequity.

KEI. How have racial and geographic factors impacted wealth inequality especially in terms of home ownership?

Perry Kinkaide. Racial and geographic factors play substantial roles in shaping wealth inequality worldwide, particularly through disparities in home ownership, which is a key driver of wealth accumulation. In the U.S. racial discrimination in housing—through redlining, segregation, and unequal access to financing—has limited home ownership opportunities for Black and Hispanic families. Even when they do own homes, properties in majority-Black or Hispanic neighborhoods are often devalued compared to similar homes in predominantly white areas, which curtails their wealth-building potential.

Geographic factors further deepen this divide. In US cities with high racial segregation, like Detroit and Baltimore, Black residents face more barriers to home ownership and asset growth than in more integrated areas. Economic opportunities also vary by state, with states in the Southeast and Midwest generally showing higher disparities and less mobility for Black and Hispanic communities compared to some coastal or urban regions. For white residents, lower-income families in regions like Appalachia and parts of the Midwest experience reduced upward mobility, driven by limited local resources and stagnant job markets, which amplifies class-based wealth gaps among white Americans as well.

KEI. What role has the modernization of farming played in shaping wealth inequality and economic decline in rural areas?

Perry Kinkaide. Modernization in farming has reduced the demand for labor worldwide, driving urban migration and affecting economic unrest and stability in rural communities. The adoption of modern farming techniques, fertilizer, and pesticides and now advanced technologies like automated harvesting and GPS-guided equipment favor large-scale farms, reducing labor needs and making it difficult for smaller farms to compete without similar capital investments. As smaller farms struggle or close, rural economies suffer, leaving behind communities with fewer job opportunities and declining income levels.

This rural-to-urban migration has exacerbated wealth inequality on a global scale, as the remaining rural residents often face limited access to resources like healthcare, education, and internet connectivity, which are essential for economic diversification. This lack of infrastructure, combined with depopulation, perpetuates economic hardship in rural communities. Children from these areas face barriers to higher education and well-paying jobs, leading to a cycle of inter-generational poverty. As a result, while modernization has benefited large farms, it has contributed to economic decline and wealth inequality in rural areas throughout the world, isolating these communities from the growth seen in more urbanized areas.

Note, for anyone following the U.S. election and trying to understand how issues differ between Red rural and inland states and Blue urban and coastal states: wealth inequality is prevalent in Red areas impacted by transitions in rural agricultural and energy economies driving urbanization and in Blue urban areas with discriminatory housing regulations. How to resolve these inequities has been a prime issue in the election.

KEI: Some people believe wealth inequality is a natural byproduct of economic growth. Do you think that’s accurate?

Perry Kinkaide: While inequality may emerge as economies grow, extreme wealth inequity is not inevitable. Growth can be inclusive if managed well. Policies can be designed to ensure that economic benefits are more evenly distributed. For example, progressive taxation, universal healthcare, and robust public education systems can all help make sure that growth leads to broader prosperity.

KEI: How would you describe the connection between wealth inequality and social discontent? Are there specific examples or trends you see that highlight this link?

Perry Kinkaide: There’s a strong link. As people feel the weight of rising costs in healthcare, education, and housing—while wages stagnate—the frustration grows. We’re seeing a breakdown in trust toward institutions perceived as serving the elite. Look at the rising support for populist movements globally; these often gain traction by addressing the grievances of those left behind by traditional economic policies. People want to feel their efforts can lead to better lives, and when that’s blocked by inequity, it breeds resentment.

KEI: Which groups, in your view, are most affected by wealth inequality, and how does it impact their everyday lives?

Perry Kinkaide: Lower- and middle-income families are hardest hit. They’re the ones struggling with stagnant wages while the cost of living rises. This disparity forces them to make tough choices—like whether to pay for healthcare or education. Financial stress takes a toll not only on individual well-being but also on family stability and mental health. It can restrict access to opportunities that allow people to improve their situation, creating a vicious cycle of disadvantage.

KEI: Does wealth inequality contribute to political polarization? How do you see this affecting social cohesion?

Perry Kinkaide: Absolutely, wealth inequity and political polarization often go hand-in-hand. When a significant portion of the population feels ignored or marginalized, they tend to align with political figures who promise radical change, even if that means moving to extremes. This divide can weaken social cohesion, as trust between different groups erodes, and society becomes fractured into echo chambers, each feeling they have little in common with the other.

| Before proceeding, please consider making a pledge by visiting KEInetwork.net Donations help us as a non-profit cover costs of maintaining the newsletter and webinars. Sponsorships are available and advertizing reasonable. Contact - Editor@KEInetwork.net |

KEI: What role should government policy play in addressing wealth inequality? Are there any policies or programs you believe have effectively addressed this issue?

Perry Kinkaide: Government policy is vital but not exclusive. Progressive tax systems that require the wealthy to contribute proportionally more can make a huge difference. Universal healthcare, affordable education, and social safety nets have proven effective in reducing inequality in countries like the Nordic nations. These policies create a foundation for equal opportunity and help lift people out of poverty while still promoting a dynamic, innovative economy.

KEI: Beyond government actions, what can businesses and individuals do to help reduce wealth inequity?

Perry Kinkaide: Businesses play a crucial role. They can adopt fair pay policies, provide comprehensive benefits, and ensure fair working conditions. Many large corporations have resources that can positively impact their communities if they prioritize equitable practices. On an individual level, people can support businesses that uphold these values and advocate for policies that support economic fairness. Small actions, when multiplied, can influence broader change.

The recent ESG movement, advocated for policies to modify investing to address environmental, social and governance issues. That movement has been muted, however, in the face of accusations of green-washing, lack of standardization, and politicization. While ESG isn’t likely to disappear; it may evolve to become more rigorous and focused on measurable, material impacts. Investors and companies are seeking ways to refine ESG practices, making them more transparent, impactful, and aligned with corporate ethical and financial goals.

KEI: Let's turn to the distribution of wealth. Critics say wealth redistribution can stifle economic growth. How do you think societies can balance these concerns with the need for fairness?

Perry Kinkaide: It’s a delicate balance, requiring I believe moderate redistribution through fair tax policies and public investments in education, healthcare, and infrastructure. It doesn’t have to stifle growth; in fact, it can create a healthier economy by promoting productivity and consumer spending. When people feel secure and optimistic about their future, they’re more likely to participate actively in the economy.

KEI: Automation and AI are transforming the workforce and could exacerbate wealth inequality. What measures do you think societies can take to adapt without leaving people behind?

Perry Kinkaide: Education and retraining are essential. We need to invest in helping workers transition into new roles where human skills are still vital. Universal basic income is one approach that could act as a safety net, though it requires careful planning and long-term sustainability. Societies that prepare workers for technological change can minimize its disruptive effects on inequality.

KEI: Education is often promoted as a solution to wealth inequality. Do you think improved access to education can make a meaningful difference?

Perry Kinkaide: Education is a powerful tool for leveling the playing field, but on its own, it’s not enough. While it provides people with critical skills and opportunities, it must be part of a broader strategy that includes affordable housing, accessible healthcare, and fair wages. It’s a multi-dimensional issue, and education alone can’t address all the underlying economic and structural challenges. By the way, when I address education I include parenting that for a civil society is prime, fundamental, and core to almost everything we have been discussing.

KEI: Finally, if you could make one change today to address wealth inequality and reduce social discontent, what would it be?

Perry Kinkaide: If I had to choose one at the public level, I’d push for a fairer tax system. A progressive tax policy would ensure that the wealthy contribute their fair share to the resources that support society—public services, infrastructure, education, and healthcare. These investments would help reduce inequity by creating more opportunities for everyone, which, in turn, could foster a stronger, more resilient society and use the revenues to provide a credit for first-time home buyers. Other measures might include: universal early-life wealth-building accounts scaled to parents' wealth, development of a universal; sponsored retirement savings accounts, reform safety net program asset tests, and limit mortgage interest test deduction.

I must add two things, first, that a serious constraint on many governments today is the size of their public debt, debt accumulated through misguided, politically inspired programs that have contributed to today's wealth disparity and increasing despair. Second, as you may have picked up from an earlier comment, I am very concerned that education including parenting is failing in their roles to prepare every generation to adapt to the array of changes they are and will continue to face on a local and global scale.

KEI: Thank you Perry. Humbling that it may be, North America may take a lesson from Europe. Despair need not continue, and protests to grow, if society - in general, and governments - specifically, take the inequity in wealth and opportunity seriously.

We are always interest to learn of your perspectives and consider articles and webinars from others in the Network.

https://us02web.zoom.us/j/84258596166?pw..

https://us02web.zoom.us/j/84258596166?pw..